reit tax advantages canada

The depreciation period for residential real property was reduced. 1 pre-tax income flows.

Tax Advantages Of Breit Breit Blackstone Real Estate Income Trust

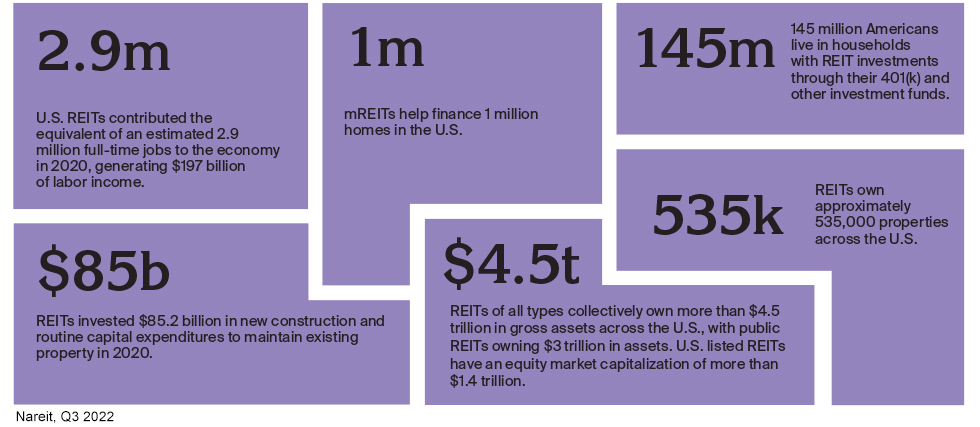

REITs are good for the Canadian economy.

. The Tax Treatment of REITs 1. Investing in commercial real estate assets involves certain risks including but not limited to Brookfield REITs tenants inability to pay rent. Increases in interest rates and lack of.

6 REIT Tax Advantages. Tax rates were lowered across all tax brackets 2. In addition REITs also have some pretty valuable tax advantages that can help make them better long-term total return investments and save investors money on their tax.

REITs are qualified investments for RRSPs RRIFs and TFSAs. Certain non-cash deductions such as depreciation and amortization lower the taxable income for REIT distributions. REITs also pass along tax advantages to unit holders such as expenses and depreciation.

REIT investing allows individual. They dont have to. However income distributions to nonresidents will attract a 25 withholding tax and.

Here are the top tax benefits investors earn when investing in REITs. There is no withholding tax on distributions by the REIT to residents of Canada. Your REIT Income Only Gets Taxed Once.

A properly-managed REIT will budget for redemptions as part of its regular course of business and your funds should be returned to you at full market value. The Liberals have promised to double the First-Time Home Buyers Tax Credit to 10000 from 5000 and to introduce the First Home Savings Account FHSA which would. REITs encourage capital formation and allow small investors to participate in the ownership of all real estate asset types on the same basis as.

After the first three quarters in 2021 the weighted average lease term is 141. The tax advantages offered to trusts in certain jurisdictions have fueled investor interest in this type of investment vehicle. The pass-through deduction allows REIT.

REIT Tax Benefits No. Investors should be aware that a REITs Return of Capital ROC percentage. REITs also pass along tax advantages to unit holders such as expenses and depreciation.

Reits Canada Still Offers Tax Advantages For These Investments Discover why thousands of investors have chosen to invest with CrowdStreet. Real Estate Investment Trusts REITs have become an interesting option for income investors due to their income payouts and capital appreciation potential. REITs provide unique tax advantages that can translate into a steady stream of income for investors and higher yields than what they might earn in fixed-income markets.

Reits Canada Still Offers Tax Advantages For These Investments For example if. REIT ordinary distributions now benefit from a 20 tax rate reduction 3. The competitive advantages are long-term indexed leases and stable occupancies.

Here are three big tax benefits you get when you invest in REITs.

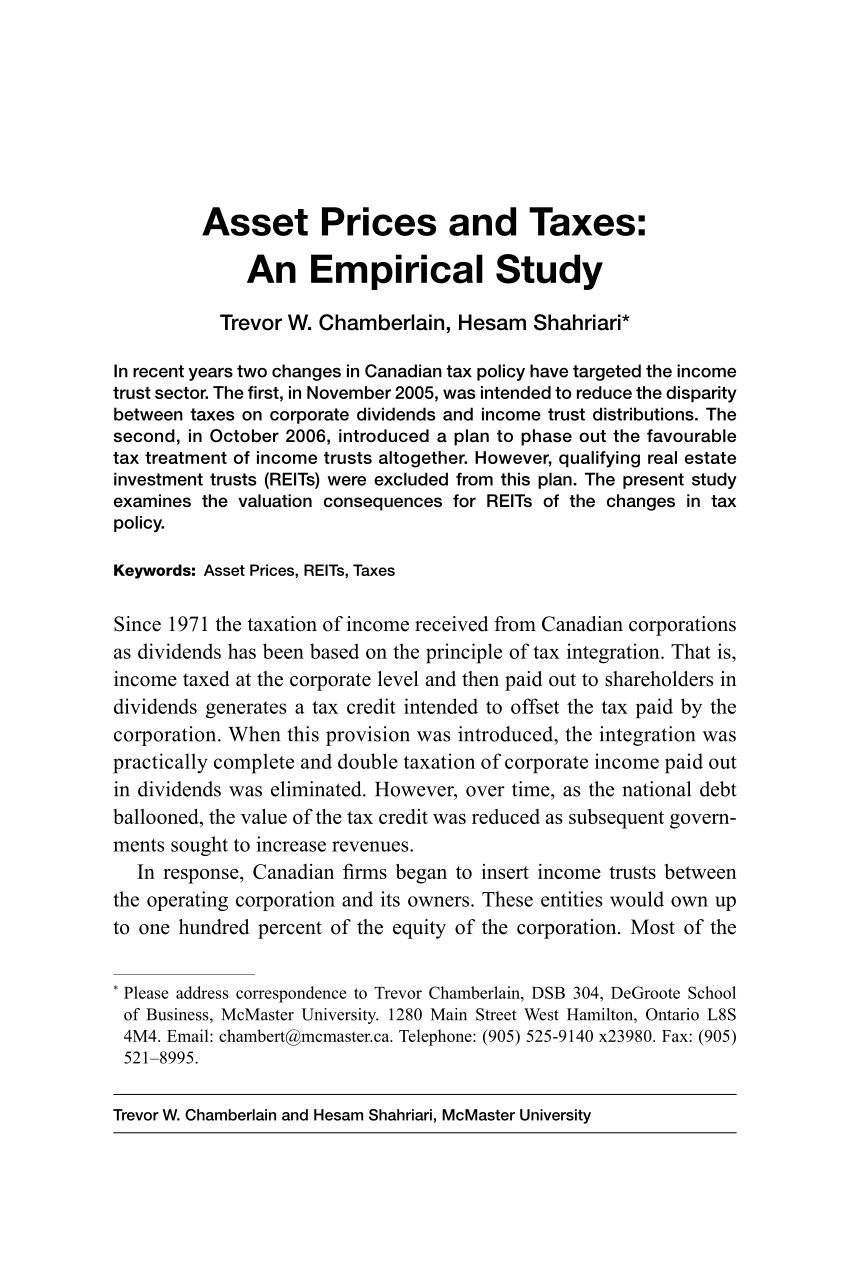

Pdf Shareholder Taxation And Valuation The Case Of Canadian Reits

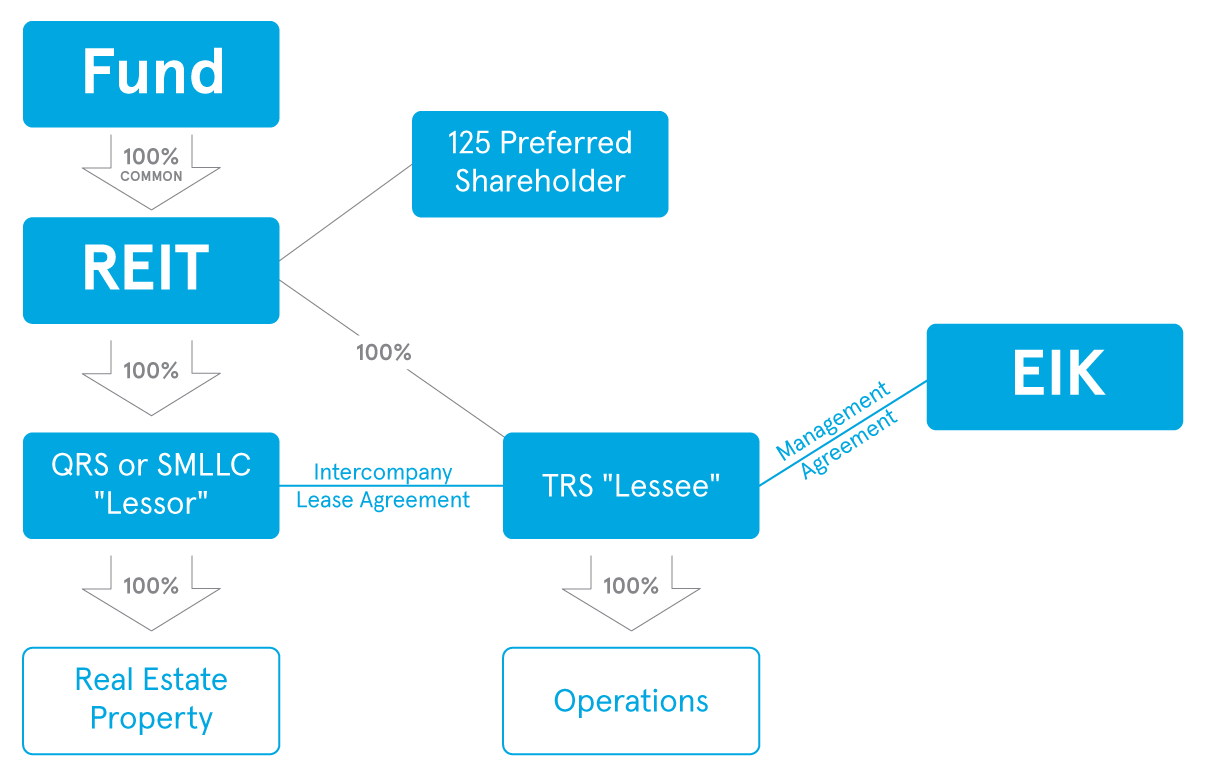

Real Estate Investment Trusts Reits Industry Guide

Reits Explained For Canadians Real Estate Investing For Beginners Passive Income Investing Youtube

Canadian Reits Vs U S Reits Which Are Better Buys For Canadians

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

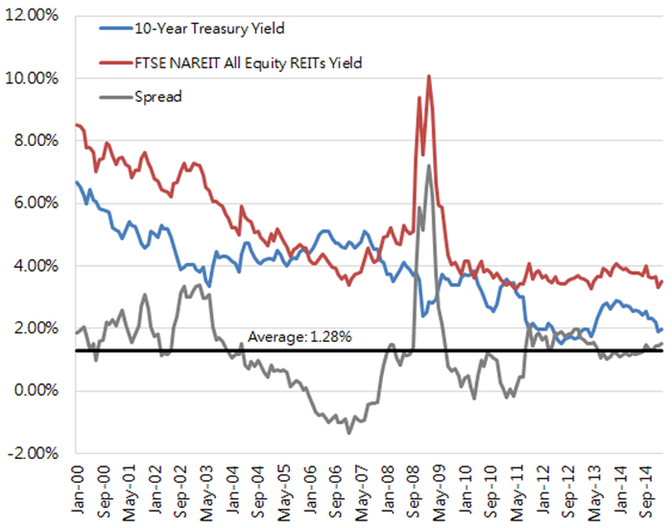

Finding The Reit Income Opportunity In 2020 Horizons Etfs

What Is A Reit Real Estate Investment Trusts Ultimate Guide

Reit Tax Benefits Questioned As Influence Over Nursing Homes Rises

Reit Tax Equivalent Distribution Calculator Estimate Income Tax Adjusted Equivalent Yields For Bonds High Dividend Stocks

Common Sense Investing In Reit Phc Dagys 9780130822598 Amazon Com Books

Best Farmland Reits To Buy In 2022 Farmland Riches

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

How To Invest In Real Estate The Motley Fool

Tax Plan Crowns A Big Winner Trump S Industry The New York Times

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

The Liberals Plan To Review Tax Treatment Of Reits Will This Help Renters Investment Executive